Formula 1’s viewing figures dropped slightly year-on-year, following on from last year’s significant decline, overnight audience numbers show.

> Both Channel 4 and Sky record marginal drops

> Anti-climatic championship fight hurt audiences

> Combined audience lowest since 2006

2017 was Formula 1’s second season on Channel 4, coverage was shared with Sky Sports. The viewing figures in this article are overnight average audiences supplied by Overnights.tv for Channel 4’s and Sky Sports’ broadcasts, including Sky Sports Main Event and Mix where applicable. Sky’s numbers are for their three-and-a-half-hour broadcast covering ‘Pit Lane Live’ and the race itself from 12:00 to 15:30, or applicable. Channel 4’s numbers broadly follow the same pattern, excluding their post-race reaction show.

Viewing figures presented in this piece exclude viewers who watched via the likes of Sky Go, Now TV and All 4. The numbers also do not include audiences who did not watch Formula 1 on the same day. Overnight audience figures are known in the industry as ‘Live + VOSDAL’ (video on same day as live). So, if you chose to record Channel 4’s highlights programme to watch on a Monday morning, you are excluded from the overnight audience numbers. Overnight figures are still important, especially for sports programming which fans view live, or as close to live as possible.

Radio audience figures are reportedly separately by RAJAR, and use a different methodology compared to television, meaning that you cannot compare BBC’s 5 Live audience figures with the television figures presented in this piece.

Channel 4’s overnight figures

In 2017, Channel 4 aired ten races live, with the remaining ten races airing in extended highlights form. Their race day coverage in 2017 averaged 1.87 million viewers, a decrease of 4.5 percent on last year’s average audience of 1.96 million viewers. Their live programming averaged 2.13 million viewers, with their highlights shows bringing 1.62 million viewers to the channel. Year-on-year, Channel 4’s live shows dropped by just 2.5 percent, whilst their highlights output decreased by 8.1 percent.

The season highlight for Channel 4 came towards the end of the season, with live coverage of the United States Grand Prix averaging 2.78m (12.8%) in peak time. One week later, Lewis Hamilton clinched his fourth world championship, resulting in an audience of just 968k (13.0%) watching Channel 4’s Brazilian Grand Prix highlights programme in mid-November.

Channel 4’s problem in 2017 was with the way they started the season, with double-digit drops for four of the first ten races. Once you start off from a low base, it is very difficult to recover that position. For the first half of the year, only Spain and Europe were the stand-out races compared with 2016, both increasing their audience figures by around 10 percent. The post-Summer break period offered more promise as Channel 4’s race day programming increased for five races on the bounce from Italy through to USA.

An average peak audience of 2.63 million viewers watched Channel 4’s programming, a decrease of 4.5 percent year-on-year. For the first time since Channel 4 started their coverage, however, the broadcaster recorded a peak audience of over 4 million viewers, with the US Grand Prix. USA was the stand out, with all of Channel 4’s other peak audiences below 3.5 million viewers, a disappointment considering three races were above the same last year. Behind USA, were Bahrain and Malaysia, both peaking with 3.42 million viewers.

Sky’s overnight figures

Now in its sixth year as Formula 1’s main broadcaster in the United Kingdom, Sky Sports’ viewing figures continued to ebb and flow, with little upsurge. Live coverage of Sky Sports’ race day programming in 2017, excluding Paddock Live, averaged 652,000 viewers, a slight decrease of 2.5 percent on last year’s average audience of 669,000 viewers.

An average of 699,000 viewers watched Sky’s exclusive coverage, whilst 605,000 viewers watched Sky’s programming when shared with Channel 4. In the pecking order for Sky, 2014 stays on top with an average audience of 790,000 viewers watching Lewis Hamilton’s third world championship; 2012 a distant second on 709,000 viewers. Sky’s other four seasons remain closely clustered together between 635,000 viewers and 670,000 viewers.

The highlight for Sky in 2017 was the Mexican Grand Prix, which averaged 1.09m (4.8%) in prime time, helped by Hamilton winning the championship on that day. Like Channel 4, Sky had a strong mid-season run, with eight consecutive races from Canada to Singapore peaking with over one million viewers, a strong run for the pay-TV platform. As a result, an average peak audience of 1.03 million viewers watched Sky’s programming across the season.

For Sky, it is likely that their Now TV and Sky Go platforms have seen increased demand compared with 2016 and before, although figures for these platforms are not available in the public domain. With only one year left though before the major switch over to pay-TV, there are no substantial signs that viewers are migrating over from Formula 1’s free-to-air product to Sky’s pay-television product despite having the access to do so.

Overall audiences

During 2017, a combined average audience of 2.52 million viewers watched Formula 1’s race day action across Channel 4 and Sky Sports, a decrease of 4.0 percent on last year’s average audience of 2.63 million viewers. F1 has lost exactly a third of its UK television audience since it left the BBC in 2015. The BBC’s television audience in 2015 was 3.74 million viewers, meaning that 2017 results in a 33 percent drop. Like last year, this year’s audience will be the lowest for Formula 1 since at least 2005.

A year that promised so much failed to deliver a spectacular championship decider. The headlines do not tell the full story, and I feel that is the case here. The battle between Lewis Hamilton and Sebastian Vettel enticed viewers, with Spain (up 6%) and Europe (up 10%) proving that point. However, their on-track battles were too infrequent to have an overarching impact. To go from a sizzling race in Baku to a cold race in Austria was to the detriment of the championship.

2016 started off on a low-note, with Formula 1 victim to a warmer Spring than usual in the UK: the season opening Australian Grand Prix lost 17 percent of its audience year-on-year. Sometimes audiences take time to arrive, and you need several good races for fortunes to turn. After Baku, the following four races failed to bring in the viewers. It was not until the Italian Grand Prix where viewing figures increased compared with 2016. And then, came the Singapore Grand Prix which ultimately decided the outcome of the championship.

What followed Singapore was a brief resurgence as Hamilton strolled his fourth championship, but audiences plunged for the final three races in Mexico (down 43%), Brazil (down 23%) and Abu Dhabi (down 20%). If you were to, hypothetically speaking, add 30 percent to the audience for the final three races, viewing figures across the entire season would be equal with 2016. One move decided the fate of the season, and with it probably sent millions of viewers around the world switching off their television sets for the final hurdle in the Formula 1 season.

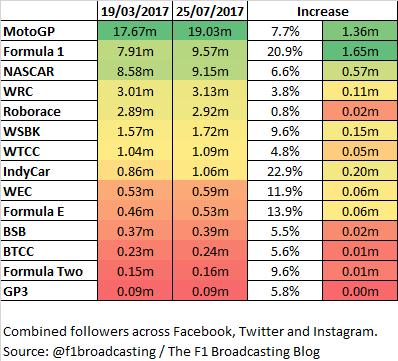

However, where Formula 1’s viewing figures drop, it remains firmly head and shoulders above the rest of the motor racing pack thanks to its exposure which no other series has in this country. On four wheels, only Formula E comes close with live coverage on Channel 5, and as documented elsewhere on this site, it is struggling to pick up a significant following. To put it into context, F1’s 2017 season average of 2.62 million viewers is ten times higher than Formula E’s 2016/17 season average of 280,000 viewers.

Is Formula 1 set for a shock in 2018?

We talk about a ‘new era’ every season, it feels like. 2019 on the broadcasting front in the UK heralds a new era with Sky Sports taking full control of Formula 1’s television rights. Before then, there is the small matter of 2018 to plough through. And with that, the Halo. Safety first, aesthetics second in this instance, with the much-derided cockpit protection system coming into force from the 2018 season.

F1 has survived, and flourished, upon major rule changes. But, arguably, the Halo is the biggest aesthetic change that F1 has seen in generations, changing the ways that cars fundamentally look to fans at home. I can write words about Hamilton versus Vettel: Part II all I want, but if the reaction is negative by media and fans, I fear that viewing figures could be set for another shock in 2018.

Halo is not meant to look attractive, that is not its purpose (you can read about the positives of the Halo elsewhere, this is not the place for that). From a broadcasting perspective however, are casual fans less likely to watch Formula 1 because of this system? The answer, in my view, is likely to be yes.

How many viewers will turn off Formula 1 because of the Halo in 2018, we do not know. But, the viewing figures for the Australian Grand Prix next March may give Liberty Media an unpleasant surprise…